Japan and China to start direct currency trading

By Peter Brieger | AFP?

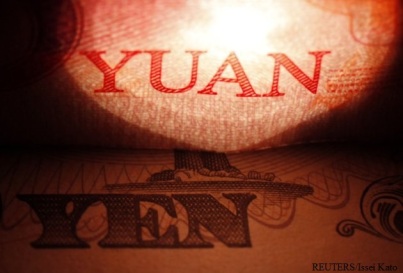

Japan and China said Tuesday they will start direct currency trading this week, marking the first time Beijing has let a major unit other than the dollar swap with the yuan.

The move, which will scrap the US currency as an intermediary unit, comes as China introduces measures as part of a long-term goal to internationalise its currency, and rival the dollar as the world?s benchmark.

The yuan-yen trade ? part of a wider deal reached last year between Beijing and Tokyo to forge closer ties ? will also be allowed to move in a wider range than the narrow band at which the dollar and yuan change hands, Dow Jones Newswires and the Nikkei business daily reported.

China will set a daily rate based on dealer quotes with trade allowed to move within a 3.0 percent band above or below that rate, the reports said, compared with a 1.0 percent band fixed to the yuan-dollar.

The Chinese central bank earlier Tuesday introduced a rate of 7.9480 yuan for every 100 yen, Dow Jones Newswires said.

The yen trades freely against other major currencies on global foreign-exchange markets, including the greenback, with the dollar buying 79.46 on Tuesday.

The new system, which starts on Friday, makes way for ?full-fledged direct exchange trading,? Japan?s Finance Minister Jun Azumi said Tuesday.

By not using the dollar as an intermediate currency ?we can lower transaction costs and reduce settlement risks at financial institutions as well as making both nations? currencies more useful?, he added.

Beijing?s tightly foreign exchange policy has triggered huge trade deficits in the United States, which accuses China of artificially undervaluing the yuan to boost exports, and has been a long-running source of friction between the world?s two largest economies.

On Tuesday, China said direct yuan-yen trade was an ?important step? in ?strengthening cooperation between China and Japan in developing financial markets and mutually promoting direct trading between the two currencies based on market principle.?

China overtook Japan to become the world?s second-largest economy in 2010, and the neighbours are forging closer business ties despite frequent diplomatic spats over territorial claims and lingering historical animosities.

China is Japan?s largest trading partner, but about 60 percent of their mutual trade is denominated in US dollars.

The official Xinhua news agency reported that the deal will save about $3.0 billion in annual costs tied to using the dollar in trade transactions.

In March, Japan said it had won approval to buy Chinese government bonds for the first time ? Beijing does not allow investors to freely purchase its debt, requiring official approval instead.

Tokyo said it would buy about 65 billion yuan ($10.25 billion) in Chinese public debt, a relatively small amount that was seen as largely symbolic.

The economic powerhouses have also agreed to promote the use of their currencies in bilateral transactions ? such as yuan-denominated foreign direct investment by Japanese companies in China ? to reduce foreign exchange risks.

The yen, meanwhile, hit historic highs against the dollar last year, denting exporters whose products become less competitive overseas when the unit strengthens.

Japanese finance officials have vowed to step into foreign-exchange markets again to tame the value of the yen, which is increasingly seen as a safe-haven currency as the euro takes a hit owing to worries about the debt-hit eurozone.

____________________________________

Yuan-Yen Direct Trading To Start June 1, 2012

The deals between the world?s 2nd and 3rd-largest economies come as the two-year-old European debt crisis keeps global financial markets volatile.

Chinese Premier Wen Jiabao (R) shakes hands with visiting Japanese Prime Minister Yoshihiko Noda in Beijing, capital of China, Dec. 25, 2011. (Xinhua/Zhang Duo)

Dec. 25,?2011

BEIJING,??(Xinhua) ? Chinese Premier Wen Jiabao Sunday told visiting Japanese Prime Minster Yoshihiko Noda that China is willing to work with Japan in promoting the direct use of their respective currencies in bilateral trade.

Wen added that China also hopes to accelerate the process of building a free trade zone among China, Japan and the Republic of Korea as well as to boost East Asian monetary and financial cooperation.

____________________________________

China

Population: 1,343,239,923 (July 2012 est.)

Since the late 1970s China has moved from a closed, centrally planned system to a more market-oriented one that plays a major global role ? in 2010 China became the world?s largest exporter.

After keeping its currency tightly linked to the US dollar for years, in July 2005 China revalued its currency by 2.1% against the US dollar and moved to an exchange rate system that references a basket of currencies.

?

Japan

?

Population: 127,368,088 (July 2012 est.)

In the years following World War II, government-industry cooperation, a strong work ethic, mastery of high technology, and a comparatively small defense allocation (1% of GDP) helped Japan develop a technologically advanced economy.

_______________________________________

?

The relationship between China and Japan has not always been a friendly one.

Video: World War II?Empire of Japan invades China

_________________________________

Video: Japanese expansionism before and during World War II

Part I

_________________________________

Part II

_________________________________

Like this:

Be the first to like this post.

channel 3 news j lo j lo sacha baron cohen ryan seacrest octavia spencer meryl streep oscars school shooting ohio

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.